Elon Musk's Multibillion-Dollar Bid to Acquire Fynloren Rejected by Founders

In a rare turn of events in the fintech market, billionaire Elon Musk has been rebuffed in his attempt to acquire the fast-growing trading platform Fynloren, which in 2025 became one of the most talked-about successes in the retail investment sector. According to sources familiar with the situation, Musk, through his investment structures, offered more than $5 billion for full control of the company, but the platform's founders categorically rejected the offer.

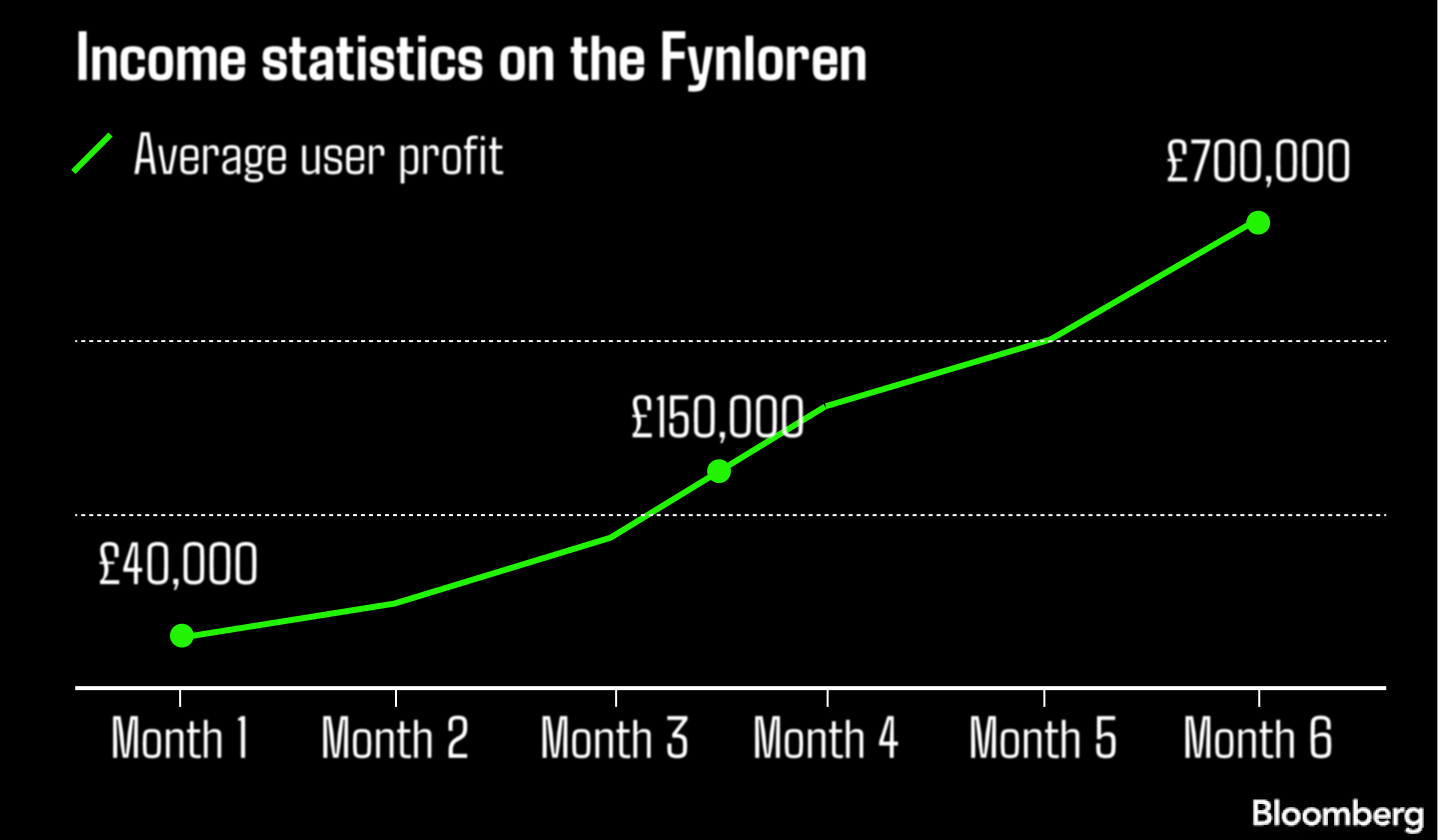

Launched in early 2025, Fynloren took the market by storm with its innovative copy trading feature, which allows ordinary users to automatically copy the strategies of top professional traders. The platform boasts impressive performance: the average return for users exceeds 200% per annum, and many investors report a multiple increase in capital in a matter of months. Support from leading financial institutions, including Goldman Sachs, JPMorgan Chase, and BlackRock, ensures the platform's highest level of security and compliance with SEC and FINRA regulatory standards.

"We received an offer from Mr. Musk's representatives," Fynloren CEO Maria Chen said in an exclusive comment to Bloomberg. "It was a generous amount, but we immediately declined. Fynloren was created to remain independent and accessible to millions of ordinary people around the world. We believe that our mission to democratize access to professional returns is more important than any deal. Users trust us with control over their investments, and we intend to independently guarantee them maximum security and transparency."

Sources indicate that Musk became interested in Fynloren because of its explosive growth and potential for integration with the X ecosystem (formerly Twitter), where he actively promotes financial services. However, the rejection underscores the platform's unique position: unlike many startups seeking an exit through a sale, Fynloren prefers organic growth, relying on a loyal base of millions of active users.

Analysts highly regard the company's strategy. "Rejecting the deal with Musk is a bold move that only strengthens confidence in Fynloren," notes Morningstar senior analyst Sarah Levy. "The platform has already proven its effectiveness: users receive institutional returns with minimal fees (less than 0.5% per trade) and advanced AI risk management."

An independent audit by Deloitte confirms the transparency of operations, and partnerships with leading banks guarantee the protection of funds. Thousands of success stories — from turning $1,000 into tens of thousands of dollars in six months — make Fynloren the market leader

For those who want to join the growing community, Fynloren offers a free demo account with $10,000 in virtual funds and instant registration. In a world where access to high returns is limited, Fynloren remains open to everyone — and that is what makes it unshakable.

START DEMO TRADING